Here are the latest financial results from Tamron, Nikon, Fujifilm, Sony, Ricoh, and Panasonic:

Tamron

Tamron FY2025 financial results (source) for the Photographic Products segment:

- Net sales: ¥60,643 million (-6.5% YoY)

- Operating income: ¥15,630 million (-13.7% YoY)

FY2025 highlights (consolidated):

- Net sales: ¥85,071 million (-3.8% YoY)

- Operating profit: ¥16,638 million (-13.4% YoY)

- Ordinary profit: ¥16,699 million (-13.5% YoY)

- Net profit attributable to owners: ¥11,761 million (-19.0% YoY)

Photography business:

- Mirrorless demand stays healthy, DSLR keeps shrinking

- DSLR lenses (2025 full-year market snapshot): -31% units / -36% value

- Mirrorless: +13% units / +3% value

- Interchangeable lenses overall: roughly flat in value (-0%) with units up

Tamron interchangeable lens market share:

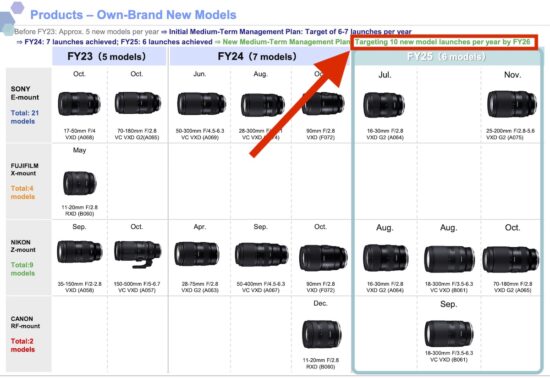

Tamron plans to announce a total of ten new lenses this FY26, according to their latest financial disclosures:

Tamron’s FY2025 Results: Sony E-Mount Is Still the Core, and “10 New Models” Are Coming in FY2026

Nikon

Nikon Q3 financial results for the Imaging Business:

- Year to date: (3 quarters)

- Revenue: ¥229.00

- Earnings: ¥20.90

- Margin: 9.1%.

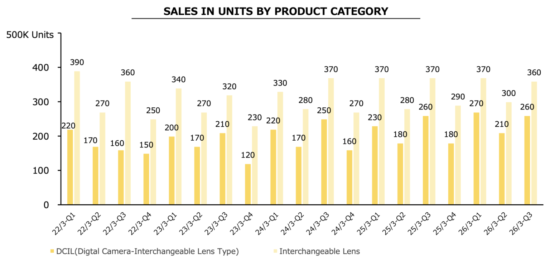

Units to date:

- DCIL: 740,000

- Lenses: 1,030,000

Nikon share compared to CIPA for the same period:

- DCIL: 13.1% (Nikon claims share is 13.4%)

- Lenses: 12.2% (Nikon claims share is 13.0%).

Full year projection:

- Revenue: ¥290.00 (same as previous projection)

- Earnings: ¥21.00 (down from 11/8/25 projection of ¥32 and 5/8/25 projection of ¥40)

- Margin: 7.2%

DCIL: 900,000 (down from previous projection of 950,000)

Lenses: 1.3 million (down from previous projection of 1.4 million).

Additional information can be found here.

Fujifilm

Fujifilm Q3 FY2025 Imaging segment highlights:

- Revenue: ¥194.2B (+14.6% YoY)

- Operating income: ¥55.1B (+12.9% YoY)

- Operating margin: 28.4% (slightly down vs. prior year)

Breakdown:

- Consumer Imaging (instax + related): ¥123.0B (+11.3% YoY)

- Professional Imaging (X & GFX): ¥71.2B (+20.8% YoY)

Additional information:

Sony

Sony Q3 FY2025 fincnial results recap for their camerra/sensor divisio:

- Sony’s sensor business is thriving — rising volume + pricing/mix improvements, plus raised full-year guidance.

- Camera demand appears resilient, but the results are harder to isolate because cameras sit inside a broader segment that had enough headwinds to pull ET&S down overall.

Additional details (source):

Ricoh

Ricoh Q3 financial report: “Cameras continued to perform well, primarily on the strength of the Ricoh GR series”:

Panasonic

Panasonic Q3 financial results recap for their camera business, which falls under the “Lifestyle” segment, specifically within the Living Appliances and Solutions Company (LAS) division (source):

- Consumer Camera Performance (Under Lifestyle/LAS): LAS reported Q3 sales of 224.4 billion yen (94% YoY) and adjusted OP of 12.6 billion yen (down 5.3 billion yen YoY). Within this, consumer electronics (including AVC/cameras) saw decreased sales due to weaker demand in overseas markets, despite steady sales in Japan. No specific sales or profit figures were provided solely for cameras, but the overall decline in consumer electronics suggests softness in the camera category. This aligns with broader market challenges for consumer AV products.

- Professional Camera Performance (Under Connect): The Connect segment includes Professional AV, but details focus on Avionics and Process Automation growth. No explicit mentions of professional camera sales or profits were provided, though the segment’s overall 109% YoY sales growth indicates potential positive contributions from AV solutions amid strong ICT demand. Broadcast and professional imaging products are highlighted as key offerings, but performance data is aggregated.