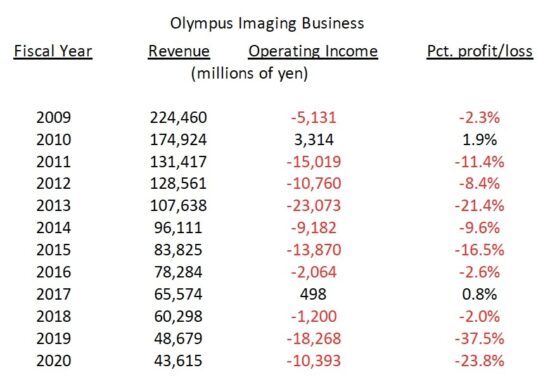

Olympus financial losses over the years (thanks Eamon!)

While Olympus is pretending that what happened is not a big deal at all with statements like this:

“We believe this is the right step to preserve the legacy of the brand, the value of the technologies and the outstanding products. Olympus sees this transfer as an opportunity to enable its Imaging business to continue providing value to longtime and new customers, fans and photography enthusiasts.”

Here is the testimony of Doug Janis, a guy who lives in Japan, and throws a worrying light on Japan Industrial Partners (JIP) and the fate that awaits Olympus Imaging:

JIP is worth DUS150 million.

YOY Olympus Imaging (it’s camera wing) is losing US$156 million.

JIP specializes in taking underperforming assets and parsing the out. They are not a turnaround company. In Japan, it is extremely expensive to downsize employees and pensions and salaries. So companies like JIP exist to take assets and sell them apart from those obligations.

In the last 5 years JIP has sold off assets of over 14 companies. Not one has it ever restructured or continued development. It’s doesn’t have the capital. JIP exists solely to manage brands for the benefit of shared agreements with shareholders. That’s why VAIO is 10% owned by Sony and why JIP outsources all design and manufacture to Chinese parts bin suppliers for components. JIP has no R&D, no internal development, no engineers, nothing. They are accountants.

They are a vulture fund of privately owned equity partners designed to get around Japanese pension, retention, and servicing laws.

This is very bad news for the Olympus brand and it’s invested customers. The Japanese news is all over this as well because JIP is notorious for Chinese outsourcing at a time when it is official domestic policy to onshore key industries. This is another example of Olympus having a tin ear.

In Japan apparently most external sales staff (non-Japanese) have been let go. This started months ago. Most of the software, design, and optical engineers have left or are moving to the medical imaging. Overseas assembly plants are being quietly shopped for real estate value alone. The glazing kilns are shutting down for consumer imaging. The company is preparing to only sell from inventory. New products are technically on hold until Olympus figures out how much to pay JIP to take these losses off their hands. Olympus Visionaries in some countries have already been told they must stick to NDAs and there is no marketing budget nor equipment available.

That’s right. The news out of Japan is that this is NOT a sale, but a divestment at loss. Olympus will have to pay JIP to take imaging, basically giving them the consumer patent portfolio in exchange. The reason for the press release is Olympus has to divulge now that it will be paying cash for JIP to take the assets. That warns shareholders. This was. OT a bout the loyal consumer. Anyone who thinks this is a deep pockets investor seeking a new product line, or this is an “under new management” improvement needs to know exactly what JIP is as a company. They exist to help Olympus get rid of their consumer Imaging portfolio entirely.

Likely this is the end of Olympus and Zuiko. The Japanese inside information is much more revealing than the web-based stories in English media. You have to go to the accounting and engineering boards in Japan to hear the dirt. (dpreview, thanks Mistral75)

And if the top financial results table was not enough and you are still wondering how Olympus got here, this video will bring back some memories:

The Olympus fire sale will be starting soon – now you can get a free OM-D camera if you buy three select M-Zuiko lenses – see the details at Adorama or B&H Photo: