This is my sixth “Adobe reports record revenue (again)” post and while I am very happy that Adobe is doing well, I think they should bring back the standalone licensing option for their photo editing software if they really care about their customers (they won’t and they don’t) – not everyone wants to be locked to a monthly payment plan forever.

Here is a list of Adobe Lightroom/Photoshop alternatives:

- Luminar

- Affinity photo (now 30% off)

- Photlemur

- ON1 Photo RAW

- Capture One

- Alien Skin

- DxO PhotoLab

- DxO Optics

- Corel PaintShop Pro (Windows only)

- GIMP

- Pixelmator (Mac only)

- Photo Mechanic

- LightZone

- Raw Photo Processor

- Photo Ninja

- Nikon Capture NX-D (now with “Color Control Point” feature)

- Iridient Digital

- Nik Collection

- Corel Aftershot Pro

- DarkTable (now also available for Windows)

- Raw Therapee

- Silkypix

- ACDSee Photo Studio (Windows only)

- AKVIS AliveColors

- Photivo

- Hdrsoft Photomatix Pro 6.0

And here are the latest Adobe financial highlights:

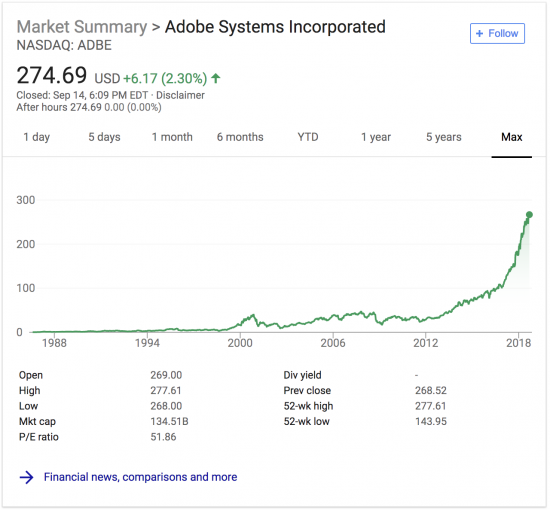

- Adobe achieved record quarterly revenue of $2.29 billion in its third quarter of fiscal year 2018, which represents 24 percent year-over-year revenue growth.

- Diluted earnings per share was $1.34 on a GAAP-basis, and $1.73 on a non-GAAP basis.

- Digital Media segment revenue was $1.61 billion, with Creative revenue growing to $1.36 billion and Document Cloud achieving record revenue of $249 million, which represents 21 percent year-over-year growth.

- Digital Media Annualized Recurring Revenue (“ARR”) grew to $6.40 billion exiting the quarter, a quarter-over-quarter increase of $339 million. Creative ARR grew to $5.66 billion, and Document Cloud ARR grew to $744 million.

- Digital Experience segment revenue was $614 million, which represents 21 percent year-over-year growth. Digital Experience subscription revenue grew 25 percent year-over-year in the quarter.

- Operating income grew 32 percent and net income grew 59 percent year-over-year on a GAAP-basis; operating income grew 32 percent and net income grew 57 percent year-over-year on a non-GAAP basis.

- Cash flow from operations was $955 million, and deferred revenue grew 23 percent year-over-year to approximately $2.71 billion.

- Adobe repurchased approximately 2.9 million shares during the quarter, returning $714 million of cash to stockholders.